Are swimming lessons tax deductible? Not yet, but hopefully soon!

On July 25, 2018, the House of Representatives approved the Personal Health Investment Today (PHIT) Act. The bill was introduced in 2018 in hopes of making a more active lifestyle accessible to youth. However, the bill was not enacted. Why? PHIT fell victim to the government shutdown.

Ultimately, Congress could not agree on an end-of-year tax bill which effectively dashed PHIT’s chances to pass. There was no longer a legislative vehicle to carry the PHIT Act. The states continue to have a high rate of inactivity even though Americans know activity is good for their health. The PHIT Incentive will encourage investments in activities to improve health.

The bill will help families with various activity costs, including pay-to-play in schools, organized team sports, individual activities, camps, clinics, classes, tournaments and qualified equipment. PHIT will also help adults’ activities because it includes gym memberships, fitness classes, personal trainers, recreational sports/activities and other eligible activity expenses.

The PHIT Act allows Americans to use a pre-tax savings account. For example, you can use a health savings account for physical activity-related expenses. In short, you can claim swimming lessons once the bill becomes law. The PHIT Act is now in the hands of Congress.

The International Health, Racquet and Sportsclub Association (IHRSA) calculated the tax break would save families an average of 20-30% on fitness costs each year. That’s likely why 78% of families support it, according to a recent survey by the National Recreation and Park Association (NRPA). The NRPA noted only 10% of Americans oppose the idea.

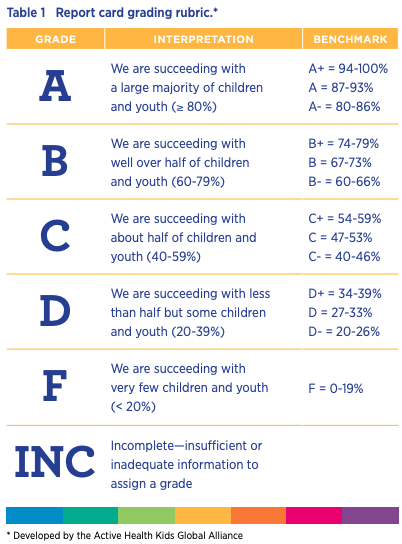

The United States earned a D- in Overall Physical Activity in the 2018 U.S. Report Card on Physical Activity for Children and Youth. Find the rubric below. Many experts graded the state of the American Youth’s activity level.

Are Swimming Lessons Tax Deductible?

The PHIT Act was reintroduced in March of 2021. However, the bill has yet to be passed by the legislature and has not been enacted into law. The goal remains unmet for the time being.

In the end, Congress has yet to agree on the bill. In May of 2021, the act was Referred to the House Committee on Ways and Means. Following this action, there have been no further updates on its status.

The Democratic House And Republican Senate will need to find common ground to move legislation through both chambers. On the bright side, PHIT has continually garnered strong bipartisan support.

What does this all mean? It means swimming lessons in the United States are not tax deductible. Stay up to date on the progress of the PHIT Act.